Published:

Preferences for Wealth Redistribution: The Role of SocialBackground and Merit

New JERP Working Paper by Elisa Stumpf and Silke Übelmesser

This paper investigates preferences for wealth redistribution through a conjoint experiment.

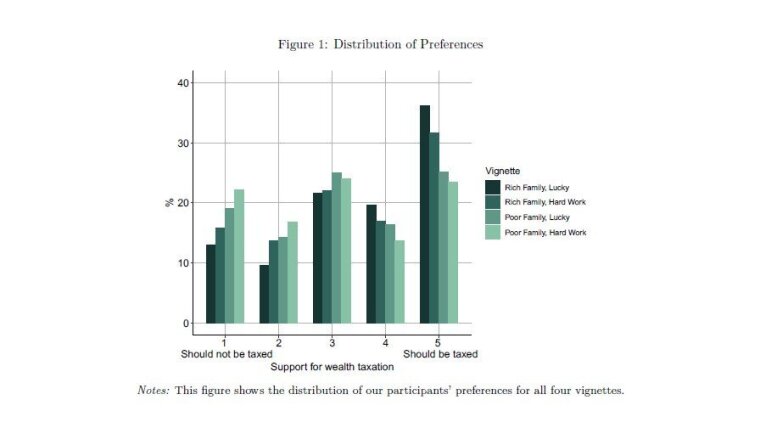

Specifically, we explore how support for wealth redistribution depends on the social background

of the taxpayer and whether their wealth is perceived as resulting from luck or hard work.

Our findings reveal significantly more support for taxing individuals from rich families, an

effect that is particularly pronounced among relatively poor participants and those with

low trust in official statistics. Attributing wealth to luck rather than effort also increases

support for taxation, though this effect is less substantial than the influence of a privileged

background. When individuals are both from a wealthy family and being perceived as lucky,

the combined effect on support for taxation is only marginally larger than either factor alone.

For the paper, please see HEREExternal link